Oregon Real Estate: 2025 Executive Summary Report

Oregon Real Estate: 2025 Year-End Review

Comprehensive Annual Analysis: Portland Metro vs. Southern Oregon

1. Portland Metro Market Analysis

The Portland Metro area defined 2025 through "The Great Balancing." While interest rates remained a hurdle, high buyer traffic—peaking at over 63,000 showings—proved that demand for the Pacific Northwest remains robust. The year closed with a shift toward a balanced market, favoring buyers who prioritized move-in-ready suburban homes.

Multnomah County Urban Resilience

- 2025 Median Price: $550,000 (Stable YoY)

- Avg. Days on Market: 35 Days

- Analysis: Multnomah remained the volume king, moving the most inventory in the state. While inner-city condos saw price compression, single-family detached homes in established neighborhoods like NE Portland held their value firmly, ending the year with strong sale-to-list ratios.

Washington County Growth & Tech Leader

- 2025 Median Price: $550,000 (Correction of -3.5%)

- Avg. Days on Market: 49 Days

- Analysis: As the hub for new construction, Washington County saw an influx of inventory that led to a healthy price correction. This has created a massive opportunity for 2026 buyers to secure modern builds in the "Silicon Forest" corridor with more negotiation power than seen in the last decade.

Clackamas County Premium Suburban

- 2025 Median Price: $640,000 (↑ 4.9% YoY)

- Avg. Days on Market: 57 Days

- Analysis: Clackamas remains the most expensive core county. Premium pricing led to longer days on market, but the limited inventory in areas like Lake Oswego and West Linn kept competition high for luxury listings throughout the winter.

Columbia & Yamhill Counties Commuter Favorites

- Columbia Median: $497,000 (↑ 6.9% — State Leader)

- Yamhill Median: $502,000

- Analysis: These counties were the surprise stars of 2025. Columbia County posted the highest appreciation in the region as buyers traded city density for more acreage, while Yamhill’s wine-country appeal kept inventory levels at historic lows.

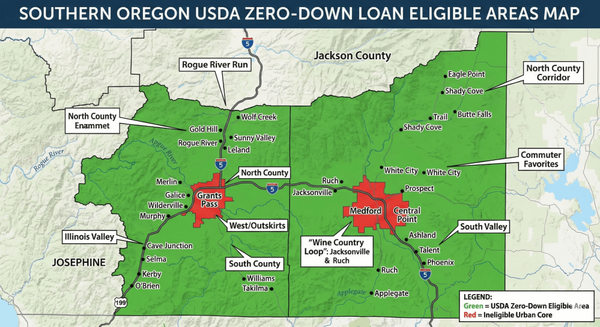

2. Southern Oregon Market Analysis

Southern Oregon moved through a period of normalization in 2025. The region acted as a "value haven" for those priced out of the Metro areas, though increased inventory toward year-end has shifted the leverage toward buyers entering the 2026 season.

Jackson County Steady & Healthy

- 2025 Median Price: $430,000 (↑ 2.4% YoY)

- Avg. Days on Market: 46 Days

- Analysis: Jackson County showed remarkable consistency. With a steady volume of nearly 200 sales per month, the market is currently "warming." Buyers are finding more choices, but well-priced homes in Medford and Ashland are still fetching near-asking prices.

Josephine County Balanced Opportunity

- 2025 Median Price: $380,000 (Correction of -3.9%)

- Avg. Days on Market: 85 Days

- Analysis: Josephine County saw a price correction in 2025 that has now stabilized. With the lowest price-per-square-foot in the region, it is the primary target for investors and first-time buyers looking to maximize their purchasing power as we head into 2026.

Klamath County Affordability Leader

- 2025 Median Price: $285,000 (↑ 4.1% YoY)

- Avg. Days on Market: 75 Days

- Analysis: Klamath remains the state’s affordability anchor. The 4.1% appreciation suggests a "flight to value," as buyers seek out the lower entry costs and strong investment potential found in the Klamath Falls area.

Data Sources: RMLS, SOMLS, and Realtor.com Research (Annualized 2025)

Categories

Recent Posts