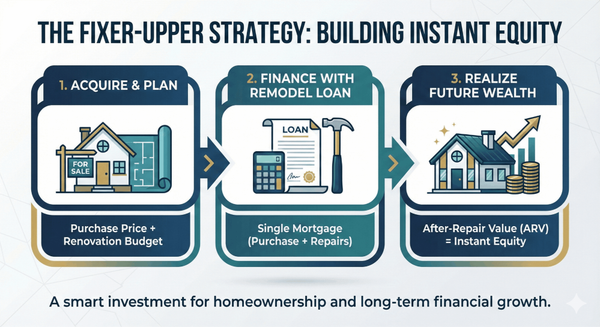

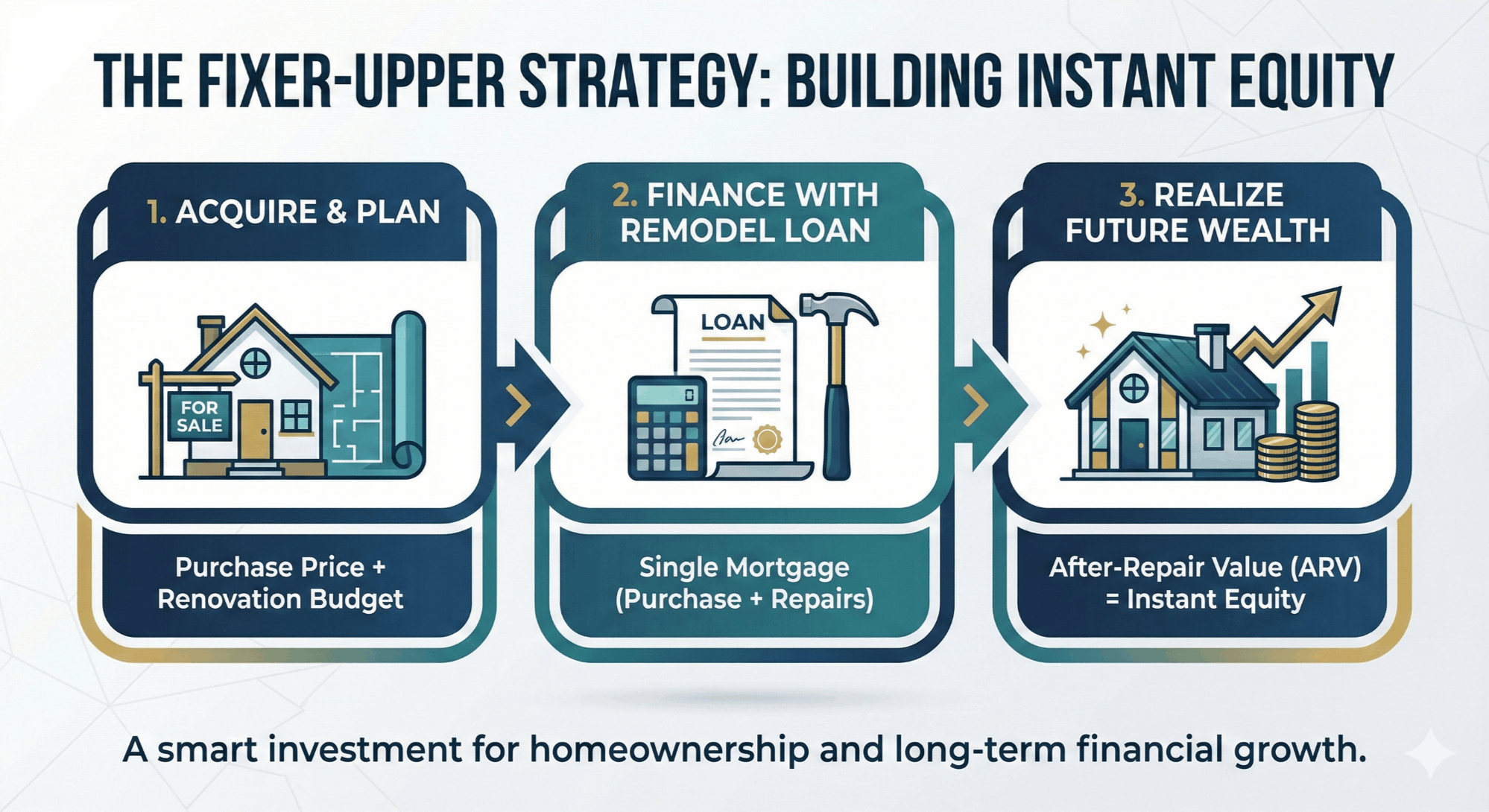

Flip Your Way to Future Wealth: The Magic of Fixer-Uppers and Remodel Loans

Dreaming of owning a home that’s perfectly tailored to your style, without the sky-high price tag of a new build? It might sound too good to be true, but there's a savvy homebuyer's secret that makes it possible: purchasing a fixer-upper with a renovation loan. This strategy allows you to roll the cost of the home and the cost of the renovations into a single mortgage, letting you create your dream home and build instant equity from day one.

What's a Fixer-Upper?

A fixer-upper is a property that needs repairs, updates, or cosmetic work. While some might see a neglected kitchen or an overgrown yard, a smart buyer sees potential. The primary appeals are a lower purchase price and the opportunity to customize the home to your exact tastes. Instead of paying for someone else's design choices, you invest in your own vision.

The Key to It All: Renovation Loans

How do you pay for the house and the remodel? A renovation loan! These specialized loans combine the purchase price of the home and the estimated cost of repairs into one convenient mortgage. The loan amount is based on the home's after-repair value (ARV)—what the house is expected to be worth once the work is complete.

Here are a few of the most popular options:

- FHA 203(k) Loan: This is a fantastic government-insured loan, perfect for first-time homebuyers. It has lenient credit requirements and a low down payment (as little as 3.5%). There are two types:

- Limited 203(k): For non-structural repairs and cosmetic upgrades, up to $35,000.

- Standard 203(k): For major projects, including structural work. It requires a HUD consultant to oversee the project.

- Fannie Mae HomeStyle® Loan: This conventional loan offers more flexibility than the FHA 203(k). It can be used for any renovation, including luxury upgrades like pools or landscaping, which FHA loans typically don't cover. It generally requires a higher credit score and a down payment of at least 5%.

- VA Renovation Loan: For eligible veterans, service members, and surviving spouses, this loan allows for the financing of both the home purchase and renovations with the benefits of a standard VA loan—often with no down payment required.

Building Instant Equity: The Real-World Payoff

This is where the magic happens. Equity is the difference between what your home is worth and what you owe on your mortgage. By buying a home for a low price and improving it, you force appreciation, creating a significant equity cushion almost immediately.

Let's look at a simple example:

- Purchase Price: You buy a fixer-upper for $250,000.

- Renovation Costs: You budget $50,000 for a new kitchen, updated bathrooms, and fresh paint.

- Total Investment: Your total cost is $300,000.

- After-Repair Value (ARV): After the work is done, a new appraisal determines the home is now worth $350,000.

In this scenario, you walk into your newly renovated home with $50,000 in instant equity ($350,000 ARV - $300,000 loan). You didn't have to wait years for the market to appreciate; you created that value yourself.

Research from sources like the National Association of Realtors® (NAR) consistently shows that specific renovations yield a high return on investment. Kitchen and bathroom remodels, for example, often recoup a significant portion of their cost at resale. By using a renovation loan to finance these value-adding projects from the start, you are essentially building wealth from the moment you get the keys. On average, homeowners can see an equity gain of 15-25% over their total investment upon completion of a well-planned renovation.

Tips for a Successful Project

- Get a Thorough Inspection: Always hire a professional home inspector to understand the full scope of necessary repairs. This helps you create an accurate budget.

- Find a Qualified Contractor: Lenders will require you to use a licensed and insured contractor. Get multiple bids and check references.

- Budget for Overages: It's smart to set aside a contingency fund of 10-20% of your renovation budget for unexpected issues that may arise.

- Focus on ROI: Prioritize renovations that add the most value, such as kitchens, bathrooms, and curb appeal.

Buying a fixer-upper isn't just about getting a good deal—it's about making a strategic investment in your future. It's a path to a home you love and a powerful tool for building long-term wealth.

Categories

Recent Posts